In the world of business, companies keep a close eye on their assets and liabilities to maintain financial transparency. Now, this same level of accountability is extending to the environment, with brands becoming more responsible for tracking and reducing their carbon footprint.

So, what's driving this change?

One reason is the increasing number of environmental regulations, such as the New York Fashion Act and California’s Climate Corporate Data Accountability Act in the US, and the EU’s Corporate Sustainability Reporting Directive (CSRD). These regulations mandate fashion companies to track and report on their greenhouse gas (GHG) emissions.

What’s more, some banks are now starting to tie loan interest rates to climate performance, incentivizing companies to track and reduce their emissions for more favorable rates.

And many fashion brands have pledged to the Science-Based Targets initiative (SBTi), which involves measuring their carbon footprint and setting targets to reduce it to meet the goals of the Paris Agreement.

However, without accurate measurements, it's impossible to set meaningful reduction targets or implement effective mitigation strategies. That’s where carbon accounting comes in.

What is carbon accounting?

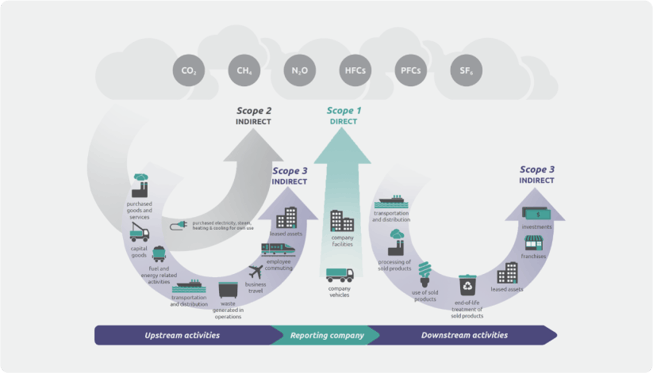

Carbon accounting is the process of tracking and measuring the amount of greenhouse gasses (GHG) emitted by an organization or activity. This includes carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), and fluorinated gasses. Gasses other than CO2 are converted into carbon equivalents (CO2eq).

Just as financial accounting paints a picture of a company's financial health, carbon accounting provides a detailed assessment of its carbon footprint.

The main question is: what is included in the scope of this measurement and how far the boundaries for the activities should be set? For fashion and footwear brands, this can be a particularly challenging task. Unlike direct emissions from company-owned facilities, the majority of a clothing company's emissions comes from indirect sources, like garment production, transportation, and waste disposal. In fact, over 90% of a fashion brand’s total carbon footprint can come from indirect sources. This, coupled with a complex supply chain, makes it difficult to pinpoint the exact sources of emissions.

As a result, many fashion brands don’t know where to start with carbon accounting, but don’t worry, we’re here to help. This article will cover everything you need to know, from understanding the different scopes to selecting the best carbon accounting platform for your needs.

.png?width=562&height=322&name=CA%20(1).png)

In the fashion industry, most emissions stem from Scope 3.

Decoding the GHG Protocol (Scope 1, 2, 3)

The Greenhouse Gas Protocol (GHG Protocol) has introduced a standardized methodology for measuring greenhouse gas emissions in the form of global warming potential (GWP), which defines the scope and boundaries of the assessment. Let’s take a quick look at what each scope includes:

Source: Corporate Value Chain (Scope 3) Accounting and Reporting Standard, page 5.

Scope 1: Direct emissions

Scope 1 emissions encompass GHGs directly emitted from sources owned or controlled by the reporting organization or institution. These emissions arise primarily from the combustion of fuels, such as gasoline, diesel, or natural gas, in company-owned vehicles, boilers, furnaces, or generators. The direct nature of these emissions stems from the organization's direct control over the fuel combustion process.

While fashion companies typically don't produce their own energy or own their own production factories, they still produce direct emissions that contribute to their overall carbon footprint, such as emissions from their own facilities (offices, warehouses, etc.) and any vehicles they own.

.png?width=586&height=335&name=CA%20(4).png)

Overview of all GHG Scope 1 categories

Scope 2: Indirect emissions

Scope 2 emissions are indirect GHGs that arise from the consumption of purchased or acquired energy sources, such as electricity, heating, cooling, and steam. These emissions are considered indirect because the apparel company does not directly burn the fuels that generate the energy. Instead, the organization purchases the energy from a third-party suppliers, such as a utility company, which provides energy for fashion retail stores, offices and warehouses.

.png?width=578&height=331&name=CA%20(5).png)

Overview of all GHG Scope 2 categories

Scope 3: Upstream and downstream emissions

Scope 3 emissions result from GHGs emitted indirectly by activities that are not directly owned by the textile brand but occur within its value chain. These emissions originate from some upstream and all downstream activities. Upstream emissions are associated with the fashion brand's suppliers and the production of goods or services, while downstream emissions are related to the use, distribution, and disposal of those goods or services.

In the fashion and apparel industry, on average, 96% of emissions stem from Scope 3 across textile brands with approved science based targets (SBTs), with Category 1 "Purchased goods and services" making up the largest portion of the overall emissions.

This category covers all the products, materials, and services a textile brand buys to make and sell its own products or services—including everything from raw materials like cotton or leather to transportation services like shipping and trucking. The complexity of the value chain and having access to the emission data throughout the supply chain is one of the biggest challenges for evaluating Scope 3 emissions.

.png?width=610&height=349&name=CA%20(6).png)

Overview of all GHG Scope 3 categories

Calculating the total corporate carbon footprint

By adding up emissions from all three scopes, you get a comprehensive picture of your fashion company’s overall carbon footprint. This information is crucial for developing effective decarbonization strategies and aligning with established corporate reporting standards like ESRS, ISSB, CDP, GRI, and SASB.

.png?width=602&height=344&name=CA%20(3).png)

Carbonfact GHG Protocol standard report feature. Learn more.

Different methods of carbon accounting

As defined by the GHG Protocol, various methods can be employed to measure GHG emissions. Each method offers distinct advantages and limitations, and the choice of method depends on factors such as the nature of the data available, the specificities of the industry or company, and the desired level of accuracy.

1. Spend-based method for GHG Carbon Accounting

Companies of all sizes use the spend-based method to estimate their emissions. As the name suggests, this method relies on financial data. This approach involves multiplying the financial expense of a product or service by an emission factor. Emission factors vary depending on the product or activity and are typically provided by a government agency or organization, such as the European Environmental Agency.

Accuracy level: Generally low to moderate

Reason: As this method relies on economic data and average emission factors, it can result in broad estimates. The actual emissions may deviate considerably from these averages, particularly in industries with diverse activities such as fashion. Moreover, due to frequent price fluctuations, this method is not a reliable tool for calculating accurate emissions and building decarbonization strategies.

2. Activity-based method for GHG Carbon Accounting

Activity-based accounting calculates how much greenhouse gas is generated by specific activities. Compared to spend-based accounting, activity-based data goes beyond financial metrics and incorporates a wider range of activity-specific data points, including measurements such as material weight, vehicle mileage, and units sold.

For instance, it can be used to quantify how much CO2 is released during transportation (kg CO2-eq per km), using electricity (kg CO2-eq per kWh), or manufacturing clothes (kg CO2-eq per kg of textile).

Accuracy level: Moderate to high

Reason: Activity-based data offers a more granular view of emissions sources, drawing on data from diverse sources, including direct measurements from entities across the supply chain. The accuracy depends on the precision of both the activity data (e.g. fuel consumption, electricity usage) and the emission factors used.

3. Hybrid method for GHG Carbon Accounting

This method, which is recommended by the GHG Protocol, uses all the activity-based data available and estimates the rest using the spend-based method.

Accuracy level: Varies, can range from moderate to high

Reason: Since the hybrid method combines specific data when available and relies on spend-based estimates when it's not, the accuracy is a blend of both. The more primary data it has, the more accurate it becomes.

4. Average-data method for GHG Carbon Accounting

The average-data method is commonly used when detailed data is limited or when initial estimates are required for screening purposes. This method uses industry-average-data (from published databases, government statistics, literature studies, industry associations, etc.) to estimate GHG emissions. Companies have relied on estimates and industry averages for Scope 3 reporting since the GHG Protocol's inception.

Considering the complexity of acquiring accurate emissions data from every supplier in the value chain, the average-data method makes it easier for fashion and apparel companies to estimate their overall emissions.

Accuracy level: Generally low to moderate

Reason: The average data method assumes that all suppliers within a specific product category have the same environmental impact. This is not the case, as there can be significant variation in emissions between suppliers due to factors such as location, production processes, and energy efficiency.

For example, the average carbon footprint of a t-shirt is 7 kg of CO2 equivalent. However, the carbon footprint could be much higher or lower depending on where and how the t-shirt is produced. For instance, a t-shirt made in India has a carbon footprint 1.5x higher than one made in Vietnam. What’s more, recycled cotton emits less carbon than non-recycled cotton. If industry averages fail to account for specific product-level factors, your results may be inaccurate.

5. Physical-unit method for GHG Carbon Accounting

The physical-unit method measures GHG emissions by tracking the physical quantities of materials or energy consumed. For example, tracking the amount of cotton used in a garment, the amount of energy consumed to manufacture it, and the amount of fuel used in transportation.

Accuracy level: Moderate to high

Reason: The accuracy of this method, which relies on actual physical measurements (e.g. liters of fuel, kilowatt-hours of electricity), is highly dependent on the precision of these measurements and the suitability of the emission factors employed.

6. Supplier-specific method for Corporate Carbon Accounting

Collects product-level data from suppliers of goods and materials to provide transparency into the upstream emissions associated with a product or service.

Accuracy level: High, provided the data from suppliers is accurate

Reason: This method uses actual emission data reported by suppliers, but its accuracy is contingent upon the reliability and precision of the data provided.

What is Carbonfact's approach?

Carbonfact is a Corporate Carbon Accounting software for the fashion, footwear and textile industry. Carbonfact unifies your corporate carbon inventory across Scopes 1, 2, and 3 into one central platform. We simplify data collection, automate calculations and ensure GHG Protocol compliance, giving you a clear path to holistic emissions reduction.

Our methodology is compliant with the GHG Protocol, and uses activity-based data (primary data to the extent feasible, otherwise activity-based secondary data).

Choosing the right solution for your carbon accounting

Now you've got a good grasp of the scopes and carbon accounting methods, let's explore the tools and experts that can help you get started with carbon accounting:

1. Industry-specific platforms

An fashion-specific emission management tool is customized for the unique workflows and demands of a particular industry. For instance, the apparel and textile industry has a complex supply chain and requires a specialized carbon accounting solution. That’s because industry-specific solutions can deliver much higher granularity due to their expertise in the supply chain.

Fashion-specific platforms like GHG inventory platforms like Carbonfact specifically focus on evaluating the environmental impact of specific products rather than just company-level data. This granular approach is essential for fashion brands as materials and manufacturing processes (Scope 3) play a significant role in GHG emissions.

Carbonfact uses primary data when available and supplements data gaps with industry expertise and anonymized customer datasets, which provides a more accurate and granular assessment compared to spend-based approaches. Carbonfact also streamlines data collection from brand systems (e.g. ERP and PLM software) to automate footprint calculations and significantly reduce data administration time.

Thanks to granular data stemming from their own primary sources, fashion brands can precisely identify emission hotspots and make informed decisions to decarbonize their supply chain.

2. Generic platforms

Generic platforms like Persefoni, Plan A, and Greenly offer comprehensive carbon accounting capabilities, catering to a diverse range of industries. These platforms typically employ a spend-based approach, using financial data to estimate GHG emissions. While this is a great way to get started with rough estimates, you won’t be able to make data-driven decisions when it comes to decarbonizing the supply chain.

3. Consultants

For organizations seeking in-depth guidance and customized solutions, consulting firms like Carbone4, Quantis, and 2050 provide specialized expertise in carbon accounting and sustainability strategy. These experts can assist in developing tailored carbon accounting methodologies, conducting comprehensive emissions inventories, and establishing effective reduction strategies.

Many fashion and apparel brands turn to consultants because they’re worried about the amount of data collection needed. But while outsourcing carbon accounting to consultants can seem like an attractive option at first, it may not be the most sustainable solution in the long run.

Consultancies often lack transparency in their calculations and methods, meaning you’ll be dependent on them to do your carbon accounting year after year. Additionally, the extensive data collection process can be time-consuming and resource-intensive, as consultants may require you to gather information from all your suppliers.

4. In-house teams

Companies with the resources and expertise may opt to build in-house carbon accounting teams. This approach allows for greater control over the process and the development of deep internal knowledge. However, it requires significant investment in personnel and training.

What is Carbonfact's approach?

Automated, expert-driven Carbon Accounting for apparel and footwear

Carbonfact revolutionizes your Carbon Accounting process by automating data consolidation and filling data gaps. This targeted approach significantly reduces manual efforts and enhances data accuracy.

With our granular intelligence across the entire supply chain, we’re able to deliver the most accurate results and offer expert advice. We help our apparel and footwear customers overcome their biggest data challenges, such as:

- Lack of structured and vetted data on the weight of components of a product

- Limited collection of primary data in energy usage and energy type among suppliers

- Suppliers struggle to accurately allocate energy usage to specific production processes and brand production activities.

Selecting the best carbon accounting software for your fashion brand

If you're transitioning from an existing carbon accounting system, conducting a thorough gap analysis is essential to ensure a smooth migration process. This involves identifying any compatibility issues, data transfer requirements, and potential training needs for your team.

Aligning your carbon accounting efforts with the SBTi is important for setting credible and ambitious emissions reduction targets. Choose software that seamlessly integrates with SBTi methodologies and reporting standards to streamline the process and ensure compliance.

Key features of carbon accounting software

The best carbon accounting software should also offer a suite of features that empower fashion companies to effectively measure and reduce their emissions. These features include:

- Automated data collection: Automatically import and sync data from any source, in any format, eliminating the need for manual entry and minimizing data-entry errors.

- Data gap filling: The platform intelligently supplements missing information with the help of industry-specific heuristics, and helps to identify hotspots to prioritize supplier data collection.

- Standardized reports: Easily generate reports that align with industry-recognized frameworks, such as GRI, CDP, TCFD, SASB, and SECR.

- Custom reports: The ability to generate custom reports such as material baskets for ESG reports, Textile Exchange or SBTi.

- Real time updates: Ingest purchase orders, to get year-to-date data for each Scope.

- Trend analysis: Track emissions over time and identify patterns to inform strategic decision-making.

- Version control: Calculations are version controlled, transparent, documented, and auditable.

- Interactive platform: Visually represent progress with interactive graphs and tables to get a clear understanding of your company's impact.

Facility view in Carbonfact Carbon Accounting tool. Learn more.

What are Carbonfact's features?

Automated and expert-driven Carbon Accounting software tailored to the apparel and footwear industry:

- Automation: Carbonfact automatically cleans and consolidates your data, minimizing manual effort and errors.

- Data gaps filling: Our platform intelligently supplements missing information, ensuring accuracy and completeness.

- Auditability: Thanks to our Version Control feature, your calculations are always transparent, documented, and auditable.

- Prioritized data collection: Focus on essential data, streamlining data collection, and reducing workload. Our platform identifies key data points to save you months of work.

Questions to ask when selecting Carbon Accounting software

When building an RFP or screening different Carbon Accounting vendors, these are some questions that you should ask.

- Is the Carbon Accounting approach compliant and certified? Does it adhere to the GHG Protocol?

- Which GHG protocol scopes does the platform cover?

- Does the platform use spend- and/or activity-based Scope 1-3 measurements?

- Which primary data sources do you typically use for Scope 3 emissions calculations (particularly Category 1)?

- Which secondary / reference data sources does the platform typically use for Scope 3 emissions calculations?

- Is the solution primarily aimed at the apparel and clothing sector or is it a cross-industry solution?

- How does the solution address the most common data gaps that apparel and footwear customers encounter?

- Does the solution support automated data collection?

- Does the solution automatically generate reports for external ESG reporting frameworks? Which frameworks does it support?

- How long is the average onboarding/implementation period?

![[Guide] Carbon accounting for fashion, textile, apparel, and footwear companies](https://www.carbonfact.com/hs-fs/hubfs/CA%20-%20Opt1.png?width=600&name=CA%20-%20Opt1.png)

Angie Wu

Angie Wu

Lidia Lüttin

Lidia Lüttin